The residential portfolio at a glance

Portfolio characteristics

- € 2.6 billion in Dutch residential properties

- Core region policy with a focus on the Randstad conurbation and inner-city areas

- Focus on the liberalised rental segment

- Continuously high occupancy rate

- Continuous outperformance of IPD property index

- High percentage of green energy labels (A, B or C label)

- GRESB Green Star

Diversified portfolio

When we are structuring our portfolio, we take into account the following diversification categories:

- Type of housing

- The indexation policy

- The rental segment

- Year of construction

- Regional spread with a focus on economically strong regions

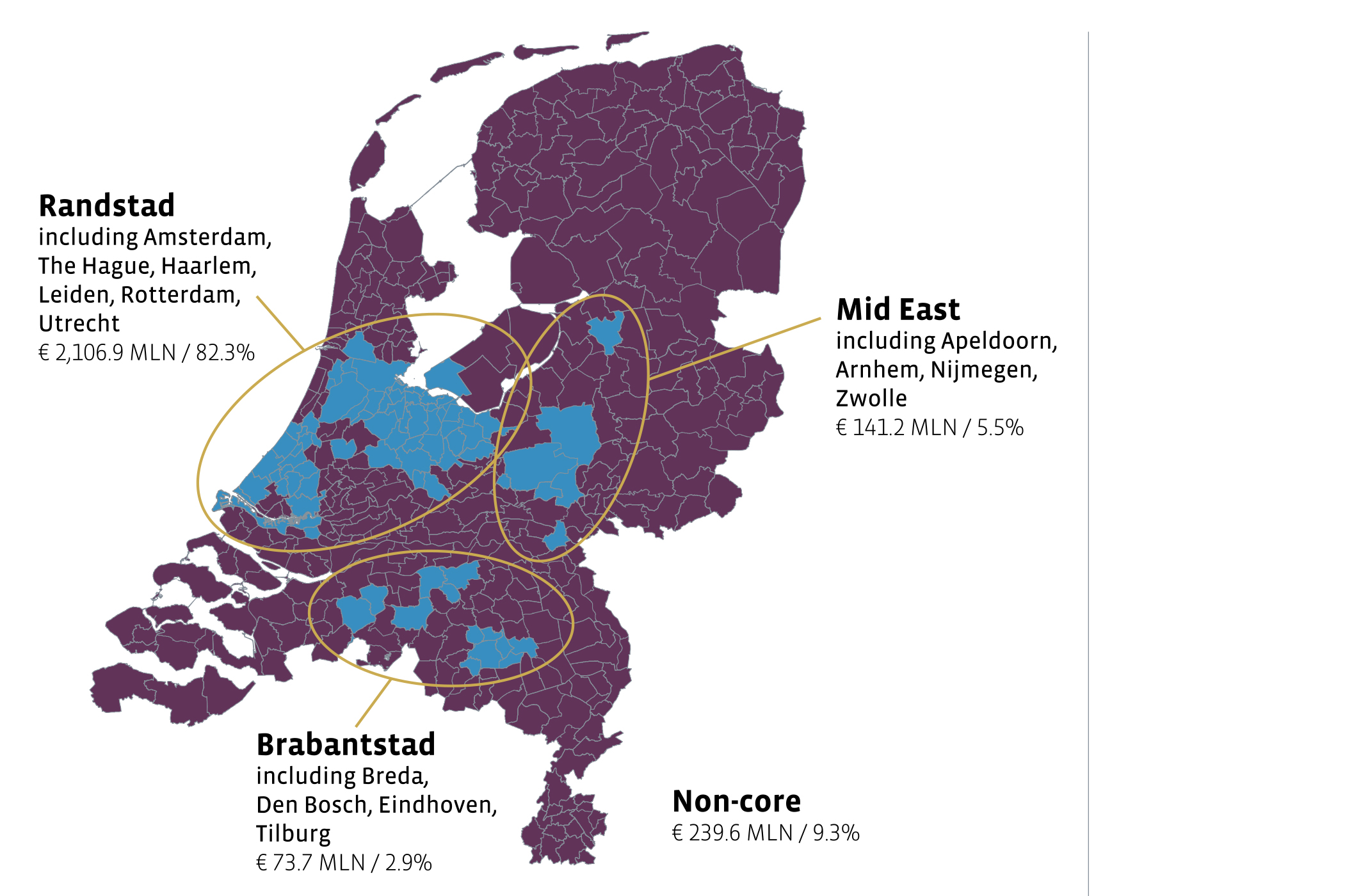

Core region policy

To identify the most attractive municipalities for residential investments, the Fund considers the following indicators:

- Population growth

- Employment opportunities

- Development in stock

- Vacancy rates

- Volatility of value development

The target is for at least 80% of the total portfolio value to be in investment properties in the Fund's core regions. This currently stands at 90.7%.

The Residential Fund's core regions based on book value

Major segments

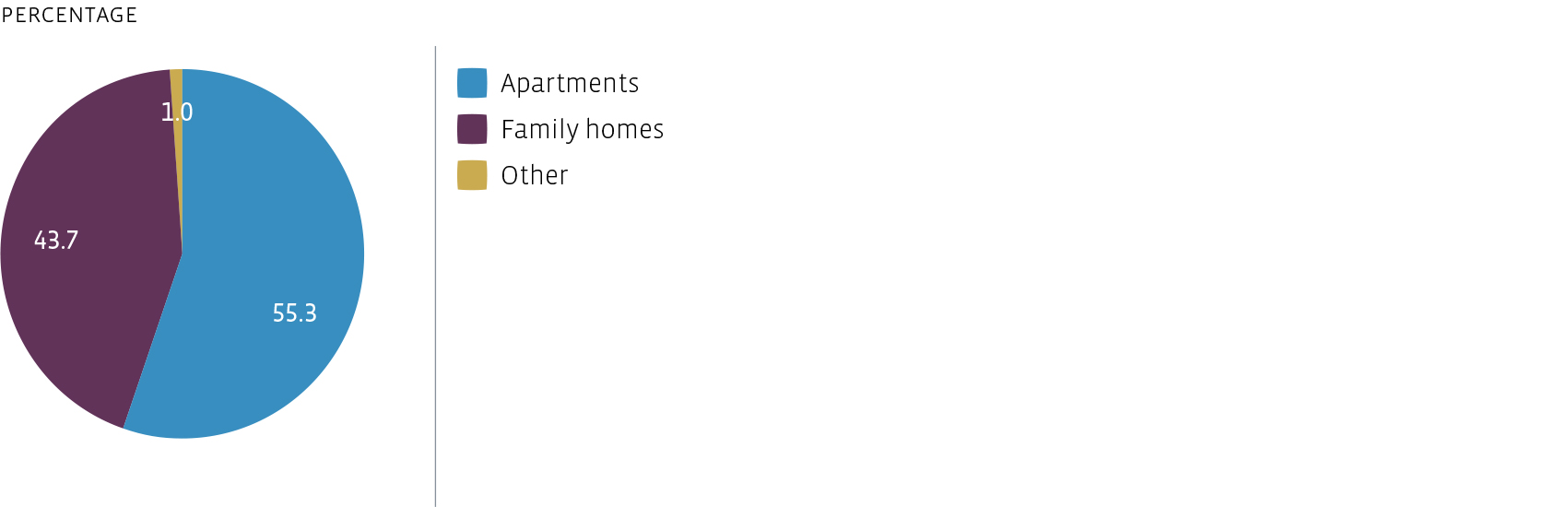

To meet its own diversification guidelines, the Fund strives for a healthy balance of family homes and apartments.

Apartments

The Fund has a diversified portfolio of apartments, with floor plans designed to meet the wishes of the various target groups.

Family homes

The Fund’s family homes generally have floor plans and lay-outs that make them suitable for a large and varied target group.

Portfolio composition by type of property based on book value

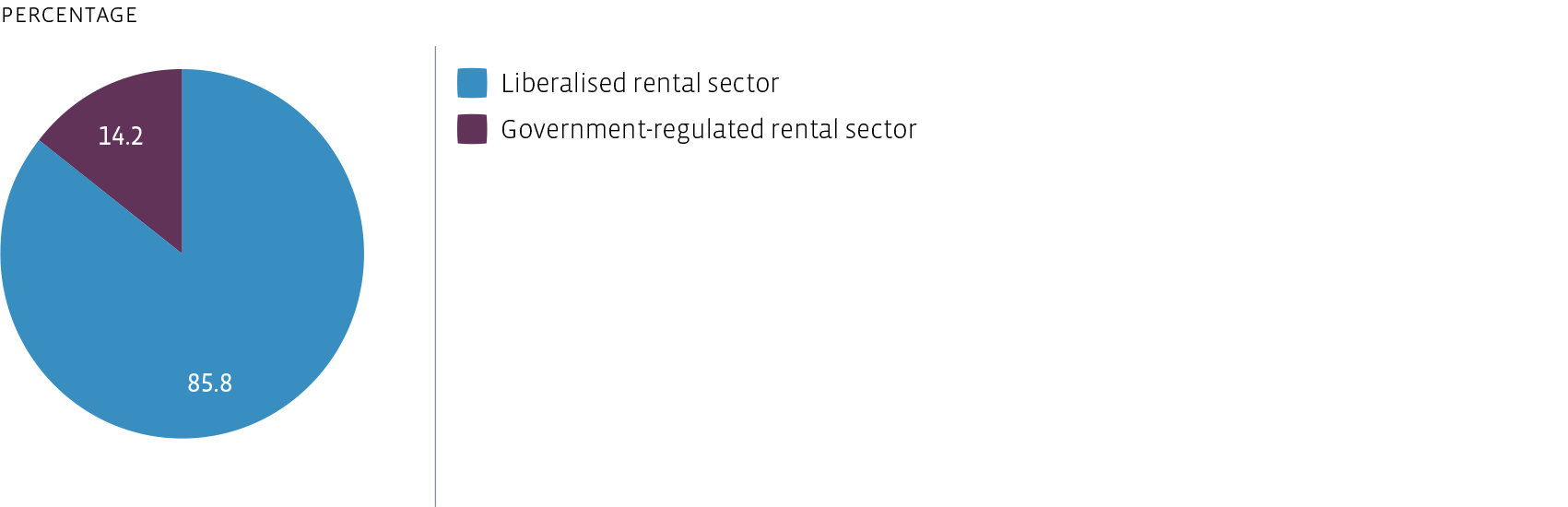

Focus on liberalised rental sector

With an average monthly rent of € 927, the focus of the Fund continues to be on the mid-rental segment. The liberalised sector (rents of € 711 and above) is particularly interesting for the Fund because rent increases in this sector are not subject to government restrictions. In addition, the liberalised rental market has in recent years become more competitive vis-a-vis the owner-occupier market. Demand is growing and supply is lagging, especially in the Netherlands’ largest and most popular cities. This is widely recognised as the best residential sector in which to invest.

Portfolio composition by type of rent based on rental income