The retail portfolio at a glance

Portfolio characteristics

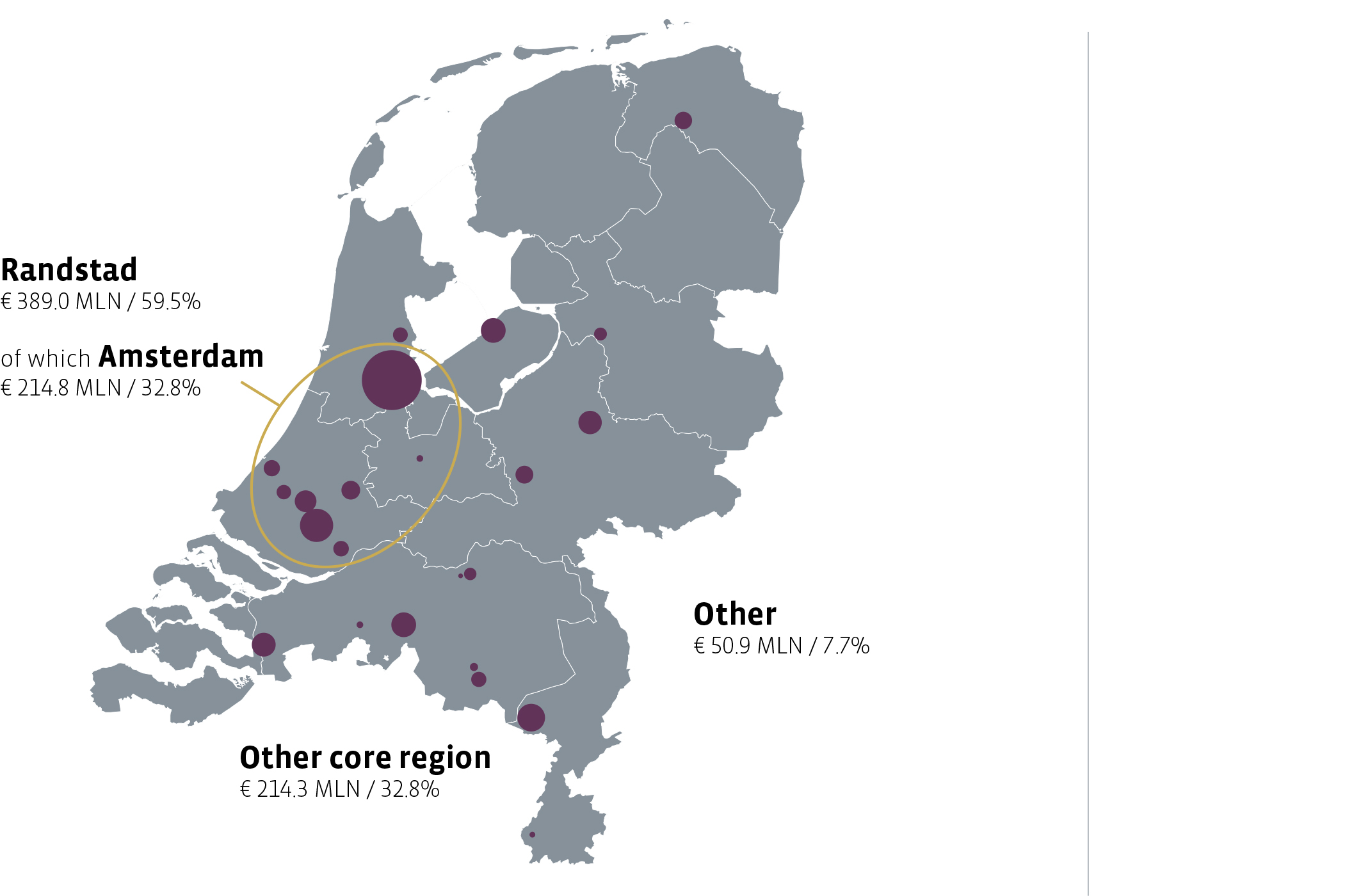

- 41 Dutch retail properties (€ 654 million; 196,537 m2)

- Focus on high street retail (Experience) and district shopping centres (Convenience)

- Focus on Randstad urban conurbation

- Continuously high occupancy rate

- Continuous outperformance of IPD Property Index

- High percentage of green energy labels (A, B or C label)

- GRESB Green Star

Core region policy

High streets: focus on A1 locations in best shopping cities

To determine the ‘best shopping cities’, Bouwinvest, including experts at its Research departments, conducts annual evaluations based on several variables. These variables include the number of ‘standard consumers’, the rent per m2 and the number of inhabitants of the specific catchment area.

District shopping centres: focus on catchment area

The economic outlook of the catchment area remains the most important criterion when assessing the location of shopping centres focusing on daily goods. When assessing new and standing assets, the Fund focuses on accessibility, parking, tenant mix, look and routing, all of which are seen as key elements in determining a shopping centre’s level of convenience.

Major segments

The majority of the portfolio’s assets consist of high-quality retail facilities. In line with our focus, the properties can be divided into two segments:

EXPERIENCE - high street retail

The main focus of Fund’s high street retail portfolio is individual high street shops or clusters of shops in retail units located in prime shopping areas in major Dutch city centres that have retained their market share and will do so in the future. The historic surroundings, the varied supply of retail formulas, restaurants and leisure facilities keep these shopping areas attractive and popular and offer today’s consumers the experience they demand.

CONVENIENCE – district shopping centres

The majority of the Fund’s district shopping centres thrive thanks to their excellent catchment areas. These easily accessible retail destinations with a wide range of products and goods cater to consumers looking for convenient daily shopping close to home. In addition to the continuous optimisation of the portfolio, the Fund also aims to invest in services and products to help local shopkeepers boost their online accessibility.

Portfolio composition by type of retail location based on book value

.jpg)