Portfolio composition at year-end 2014:

- 30 properties across the Netherlands

- 285,062 m2 of lettable floor space

- Total value investment property € 560 million

Diversification guidelines and investment restrictions

During the financial year, the Fund adhered to the guidelines and restrictions as defined in the Information Memorandum.

| Diversification guidelines | Current portfolio | Conclusion |

| ≥ 80% of investments invested in core regions | 91.5% in core regions | Compliant |

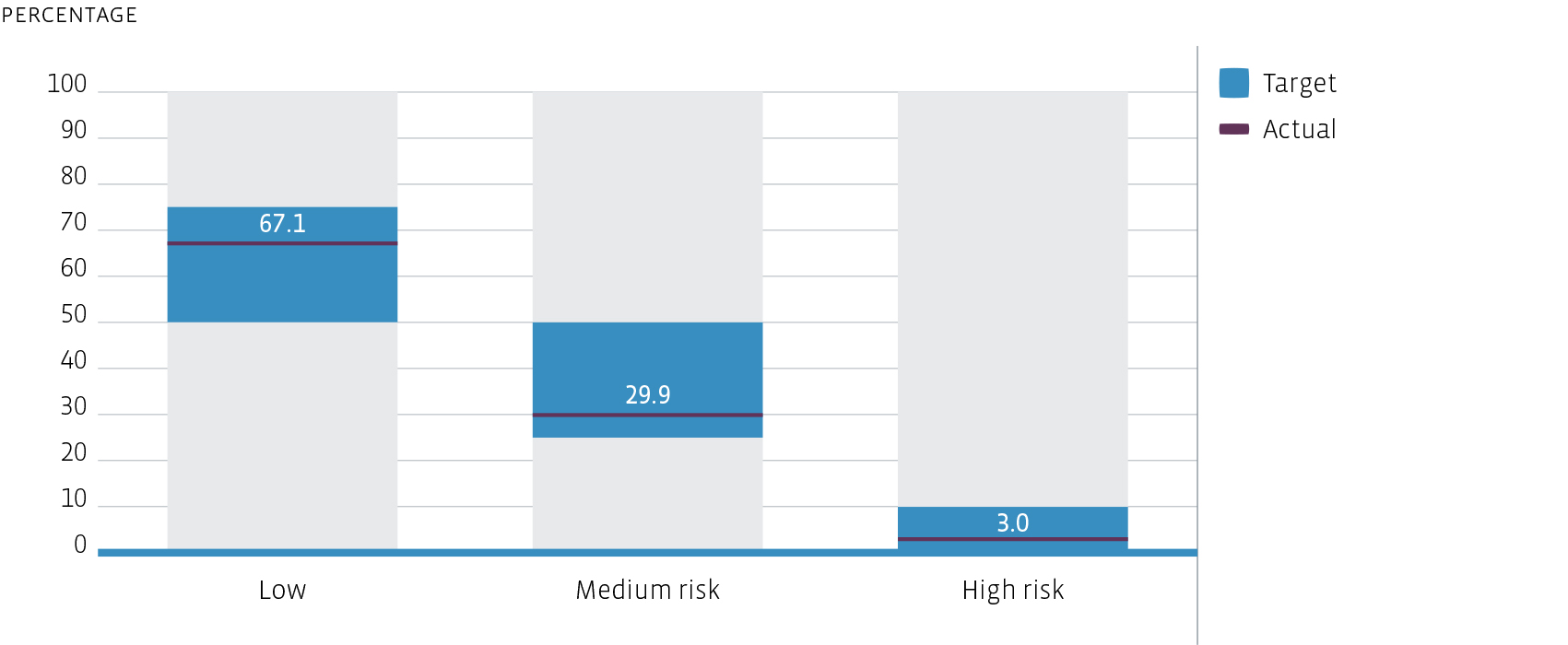

| ≥ 90% of investments invested in low or medium risk categories. At portfolio level: | 97.0% in low and medium risk | Compliant |

| 50-75% low-risk investments | 67.1% low-risk investments | Compliant |

| 25-50% medium-risk investments | 29.9% medium-risk investments | Compliant |

| < 10% high-risk investments | 3.0% high-risk investments | Compliant |

| Investment restrictions when the total investments of the Fund are > € 750 million | | |

| < 15% invested in single investment property | There are two investment properties exceeding 15% (*) | N/A |

| < 10% invested in non-core office properties | All the investments are in offices | Compliant |

| < 10% pre-finance acquisitions | Investments under construction are 1% | Compliant |

| No investments that will have a material adverse effect on the Fund’s diversification guidelines. | There have been no investments in 2014 that have a material adverse effect on the Fund's diversification guidelines | Compliant |

Download XLSInvestments, divestments and redevelopments

With our investments in turnkey assets, redevelopments, renovations and sustainability, total investments came in at € 138.1 million in 2014. All the acquisitions are multifunctional and/or multi-tentant office buildings.

Acquisitions

Valina, Amsterdam

In the beginning of 2014, the Fund acquired the Valina office building and subsequently started redeveloping the outdated building to a modern, future-proof and sustainable workplace. Practically at the same time we started the redevelopment, the Fund closed a new lease for the entire building with WPG Uitgevers, which was looking to centralise various smaller WPG offices scattered throughout Amsterdam into one central location. Easy access to Valina by both public transport and car as well as the look and feel of this energy-efficient building, were important factors in the new tenant's decision-making process. The delivery of several new residential properties by Bouwinvest's Residential Fund and a new Casa400 hotel (Hotel Fund) in this area have helped to further boost the living and working environment for now and in the future.

Citroën buildings, Amsterdam

In December 2014, the Office Fund acquired two former Citroën buildings (garage and office/showroom) in the Olympic area of Amsterdam Zuid. The 6,000-m2 and 14,000-m2 buildings are close to several Bouwinvest assets, including the Olympic Stadium office complex with its 850 parking spaces (Office Fund) and over 400 residential units of 'Het Kwartier' (Residential Fund). The redevelopment of the two iconic Citroën buildings will comprise a transformation into multifunctional, multi-tenant complexes including offices, shops and catering facilities. The acquisition is fully in line with the Fund’s strategy of focusing on multi-functional, multi-tenant office complexes with additional facilities.

Beurs-WTC Rotterdam

This major investment was special in many ways. For starters, the transaction was closed with holding company Beurs-WTC after it appeared that the city’s municipality evaluated that a transfer of shares (50%) appeared impractible. Prompt decision-making from all shareholders was needed to authorise the deal. Secondly, the total transaction involved both office and retail space and excellent cooperation between the Office and Retail Fund led to a single purchase agreement. The investment by the Office Fund comprises around 37,000 m2 of offices, a 7,000-m2 congress and events centre and 2,000 m2 for other commercial use. It also provides 467 parking spaces. The multi-tenant and multi-functional characteristics, its city-centre location and excellent public transport accessibility were key for the Fund to insulate the investment against rapid changes in demand for business space.

Acquisitions in 2014

| Asset | City | m2 | Theoretical rent |

| Valina | AMSTERDAM | 3,575 | 739 |

| Citroën | AMSTERDAM | 18,453 | - |

| Beurs-WTC | ROTTERDAM | 48,753 | 10,221 |

Download XLSDivestments

The Fund did not divest any assets in 2014, due to low pricing. The Fund once again invested in upgrading existing stock in preparation for disposals through new leases and lease renewals. The Fund has started a divestment program for a total of 12 assets it considers non-core. Although the Fund Plan did not initially include CentreCourt in The Hague, the Fund did enter negotiations due to interest from international investors. These talks did not result in a transaction in 2014.

Optimising the risk-return profile

In terms of risk diversification, at least 90% of the investments must be low or medium risk. At portfolio level, we have identified the following bandwidths to budget the risk:

- 50-75% low risk

- 25-50% medium risk

- 0-10% higher risk

The target risk and the actual risk allocation as at year-end 2014 are shown in the figure below. However, during the year, the low-risk and medium-risk categories exceeded the bandwidths. Every year, all properties are assessed separately and this caused a major shift in the composition of the risk profile during 2014. This change was mainly due to a segmentation for the offices and parking of Olympic Stadium (Amsterdam) and Maasparc (Rotterdam). The proven positive track record of these spaces led to a lower risk profile. Despite exceeding the bandwidths, the overall risk profile remained low and was as such consistent with the framework of the Fund conditions. A lower risk profile is also acceptable in relation to the objective to achieve a stable and predictable Fund return.

The end-of-year acquisitions of both the Citroën buildings and Beurs-WTC Rotterdam are considered assets with a medium risk profile. As a result, by year-end, the risks were spread within the given bandwidths. Future redevelopment investments related to the Citroën buildings will further increase the medium-risk category and lower the low-risk category.

Portfolio composition by risk category based on book value

Diversification

Focus on central locations in core regions

To identify the most attractive municipalities for office investments, the Fund takes into account indicators such as:

- Population growth

- Employment opportunities

- Development in stock

- Vacancy rates

- Volatility of value development

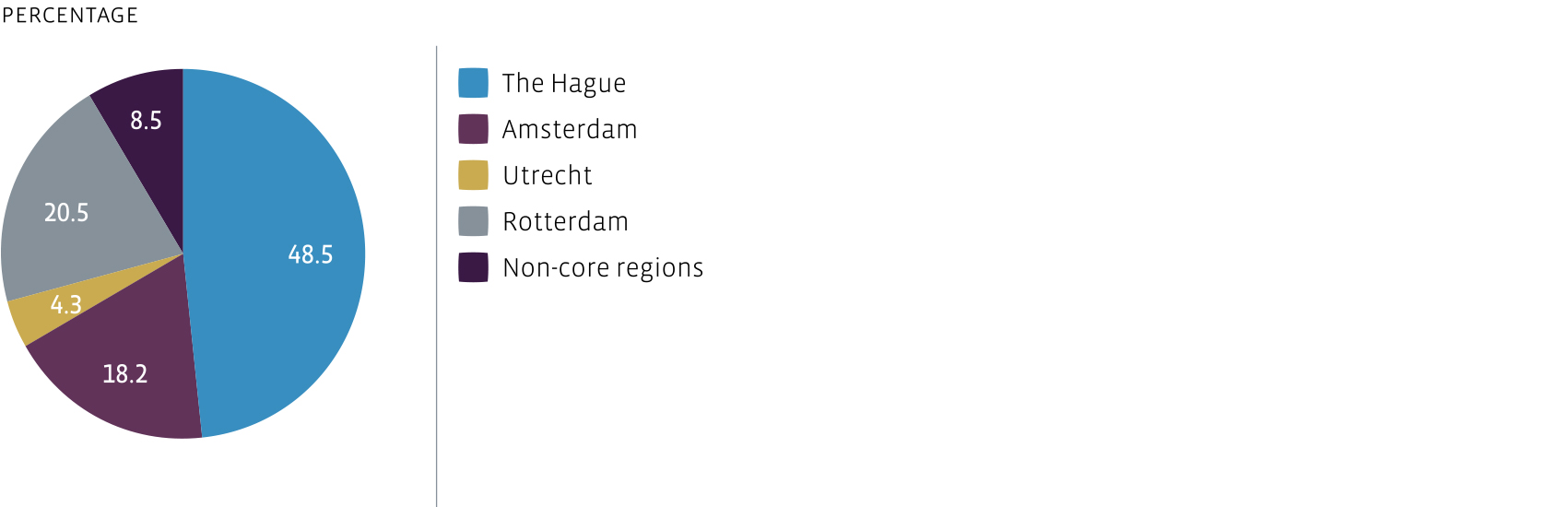

Amsterdam, Rotterdam, The Hague and Utrecht are considered prime office regions. In 2014, following acquisitions made in Amsterdam and Rotterdam, 91.5% of the Fund’s assets were located in these four cities and just over 91.5% were located in the identified core regions, while the Fund’s diversification guidelines stipulate a minimum of 80%.

As a result of the 2014 investments in the Citroën buildings (Amsterdam) and Beurs-WTC Rotterdam, the portfolio compisition by core region was more evenly spread by year-end, as The Hague's share decreased from 62.2% in 2013 to 48.5% in 2014, while Amsterdam’s and Rotterdam’s shares increased by 2.8%-points and 15.5%-points respectively.

Portfolio composition by core region based on book value

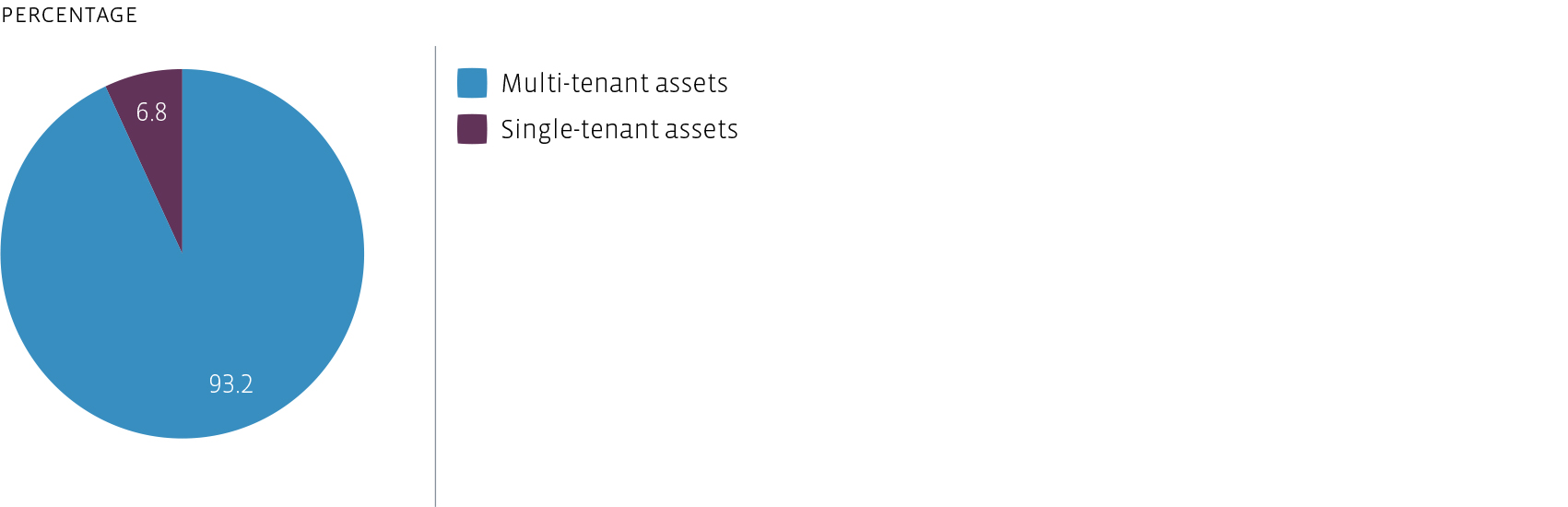

Focus on multi-tenant, multifunctional, multimodal office concepts

Multiple lease agreements reduce the volatility of revaluations and help increase the control of asset management risks. Furthermore, the Fund focuses on locations that attract a widely diverse group of people and offer a mix of culture, education, sport and work facilities.

Portfolio composition by single vs multi-tenant based on book value

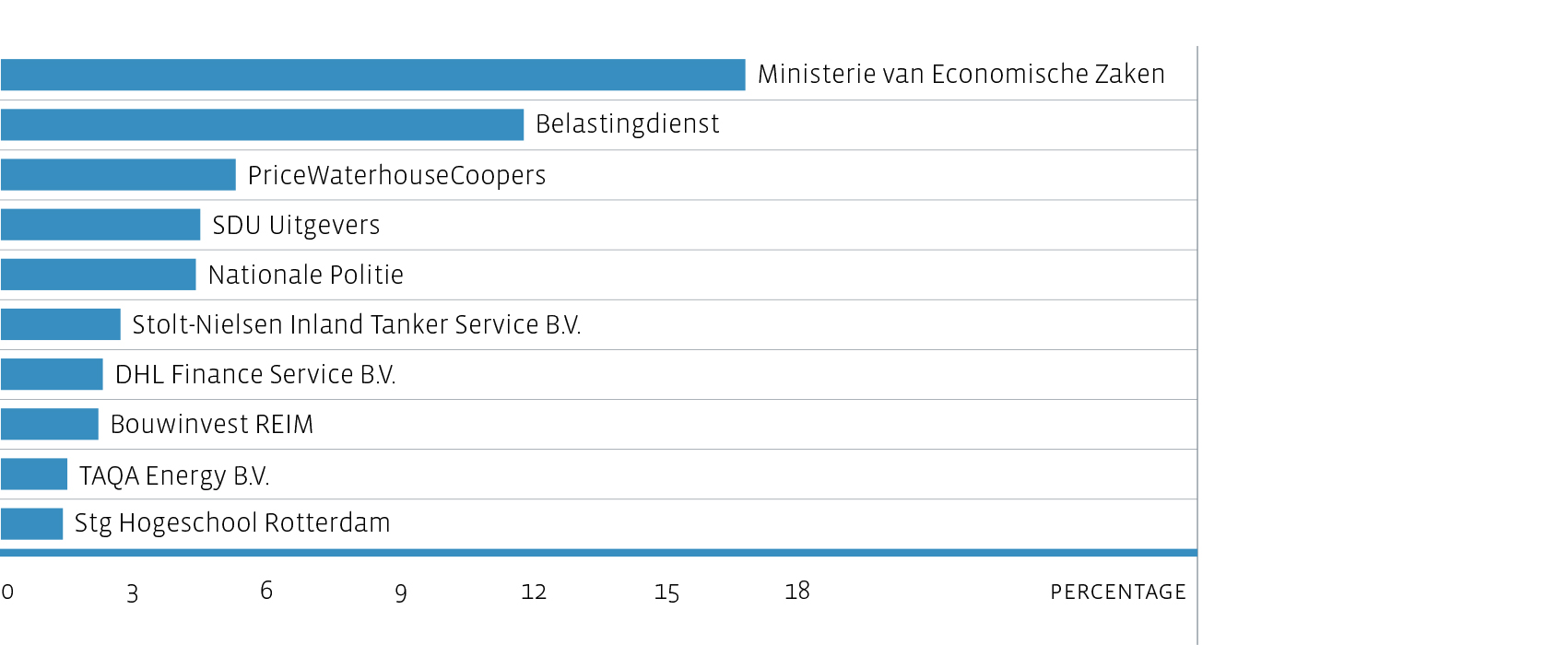

Tenant mix

All tenants are considered to have a low debtors risk. The top ten tenants account for a total of 53.0% (2013: 60.7%) of the theoretical rent. The lease with Nationale Politie (Dutch National Police Force) was extended in December 2014. No top ten tenant has given notice that it wishes to end its lease. We maintain close relationships with all tenants to ensure satisfied customers.

The Office Fund’s top 10 tenants

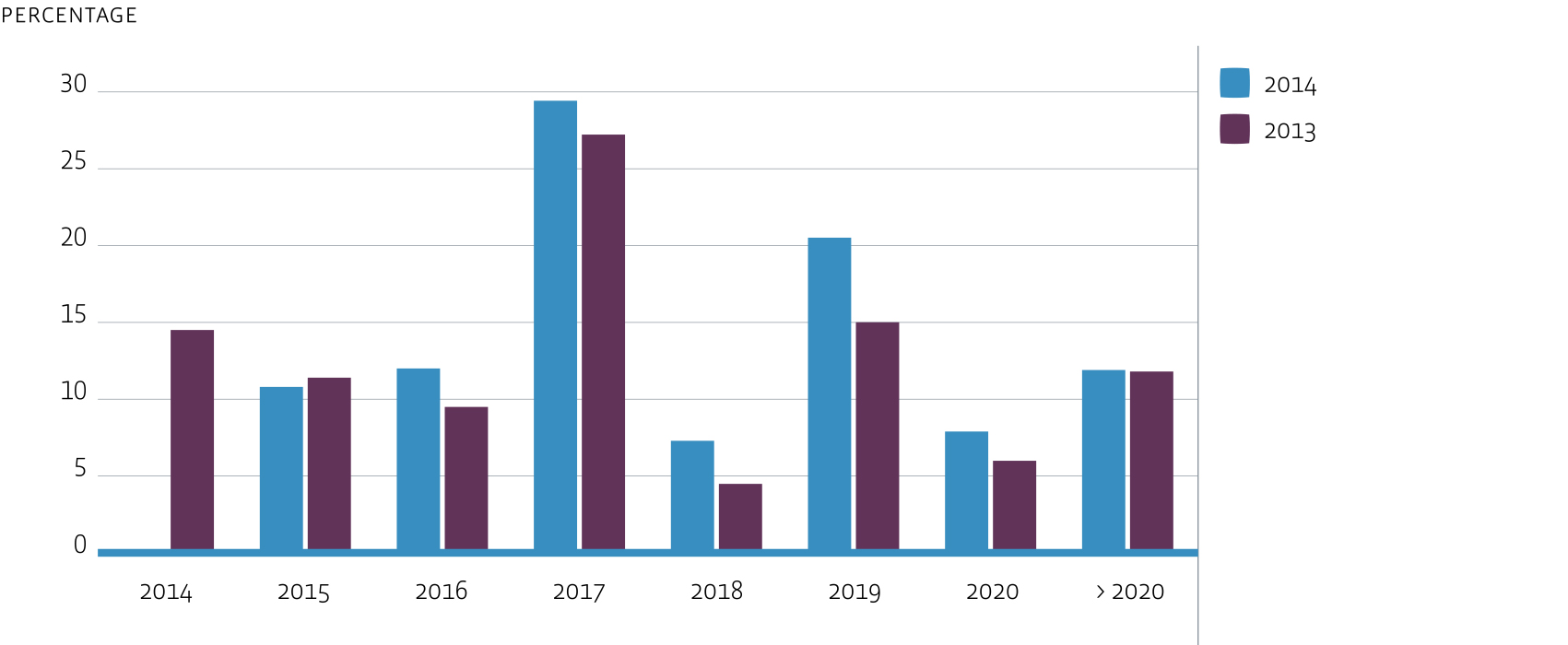

Expiry dates

The relatively high percentage of expiry dates in 2017 and 2019 is a result of possible ending leases with two large tenants. The average remaining lease term stood at 3.8 years, marginally lower than the 3.9 years at year-end 2013.

Expiry rates as a percentage of rental income

Active asset management

Bouwinvest devotes a great deal of attention to maintaining high occupancy levels by developing close relationships with tenants and property managers. Thanks to its excellent customer focus, knowledge, experience and a broad network, the Fund is able to respond (pro-actively) to users’ changing requirements for office space. On top of this, Bouwinvest’s research and marketing teams help the Fund to anticipate and respond to market trends and demographic developments.

WTC The Hague

WTC The Hague is a prime example of an office building of the future. Based in a multifunctional location, offering flexible office concepts and services to a variety of large and smaller businesses, WTC The Hague is a frontrunner in its region.

In 2014, the Fund took several measures to further optimise WTC The Hague, including the introduction of a new innovative parking system with automatic licence plate recognition. This made the parking facilities more user-friendly and simplified the operational management of various clients, such as hotel and congress visitors.

The Fund initiated a number of actions to promote the leasing of C Tower, in anticipation of the end of the lease with telecom firm KPN (11,361 m2). These included setting up a show office, which is being used for networking events with potential tenants, real estate agents and other stakeholders.

In 2014, the WTC International Business Club teamed up with the WestHolland Foreign Investment Agency, the Dutch Council for Trade Promotion, the Chamber of Commerce and The Hague city council to organise numerous networking and business promotion events.

To further boost our amenities, WTC The Hague launched new business services last year, including the Yclean car wash service, Smart eBikes, an in-house service desk and the Travelling Tailor.

New leases and lease renewals

The five-year average outperformance of the IPD Property Index is mainly the result of active asset management, which led to a total of new and renewed leases of 22,507 m2 and an annual rent of € 4.1 million.

The most significant lease renewals were:

- Nationale Politie for Europe Palace (Zoetermeer, 11,296 m2)

- Spotzer Media Group for De Lairessestraat (Amsterdam, 526 m2)

- KidKraft Netherlands for Olympic Stadium (Amsterdam, 354 m2)

- Stichting Topsport Amsterdam for Olympic Stadium (Amsterdam, 303 m2)

The Fund also succeeded in signing several new leases. In many cases, these were the result of investments in refurbishments executed in advance to attract new tenants.

New leases include:

- Oilinvest (Netherlands) for WTC The Hague (The Hague, 700 m2)

- Stichting Max Havelaar for Arthur van Schendelstraat (Utrecht, 306 m2)

- Regionale Ontwikkelingsmaatschappij Zuidvleugel (Innovation Quarter) for WTC The Hague (The Hague, 642 m2)

Despite the trend towards more flexible lease agreements, most new and renewed leases are still 5-year leases.

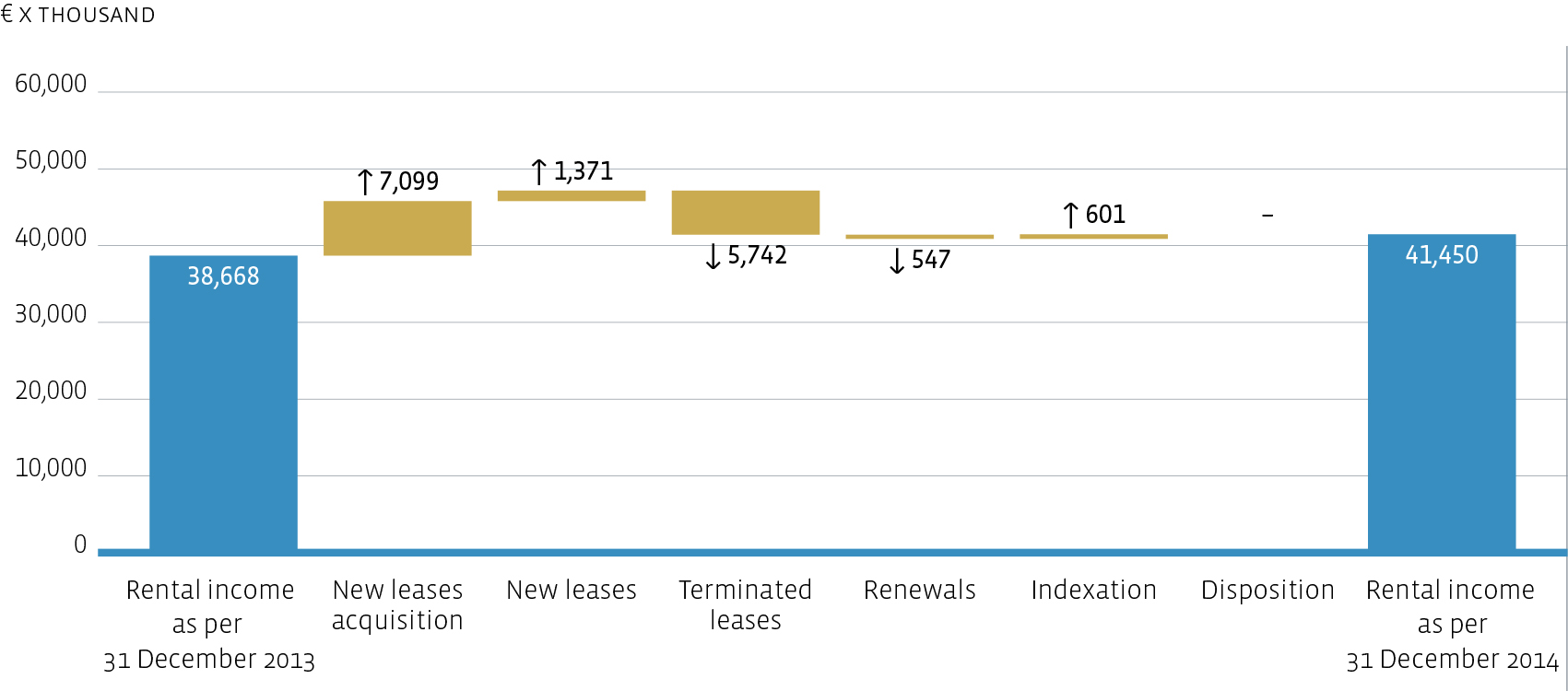

Movement in annual rent in 2014

Lease renewals led to a lower annual rent, because the newly agreed rents were lower than current rents. A reduction of rent provided an incentive to extend existing lease contracts. This enabled the Fund to keep the average weighted remaining lease term at 3.8 years. It also led to an increase of secured rental income.

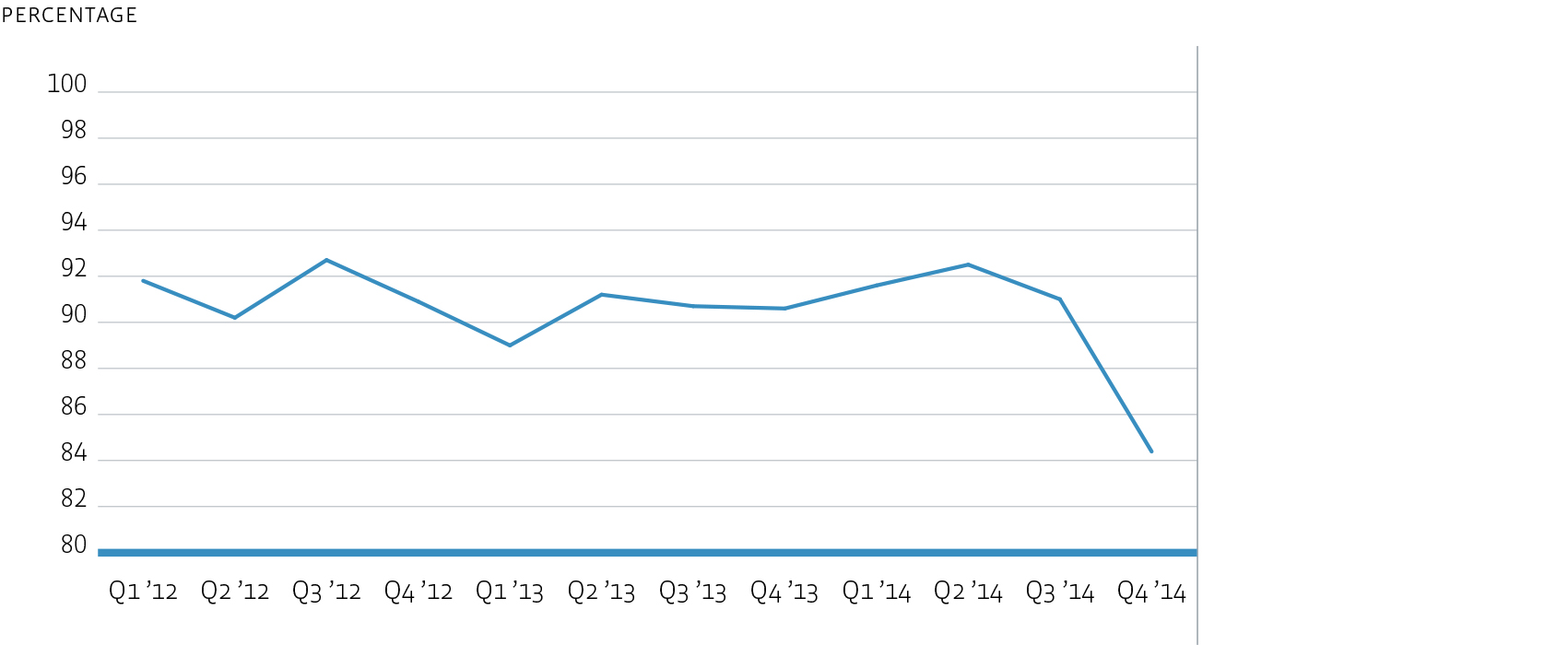

Financial occupancy

The ending of the lease contract with KPN for WTC The Hague (11,361 m2) was the key factor in the drop in the occupancy rate in the fourth quarter of 2014. Financial vacancy by year-end also included spaces vacated by the Utrecht city council at Arthur van Schendelstraat (Utrecht, 4,328 m2). Although the lease was set to expire in June 2015, the city council paid a redemption fee for the early termination of this lease. This early termination will enable the Fund to renovate the office space before June 2015 and prevent real financial vacancy. A further drop in the occupancy rate is foreseen as a consequence of (relatively) low occupancy for Beurs-WTC Rotterdam. The recently acquired Citroën buildings will remain vacant for the following two and a half years, while the Fund redevelops the buildings. After completion, we foresee an increase of the occupancy rate as new lettings for these new investments are promising.

Financial occupancy rate

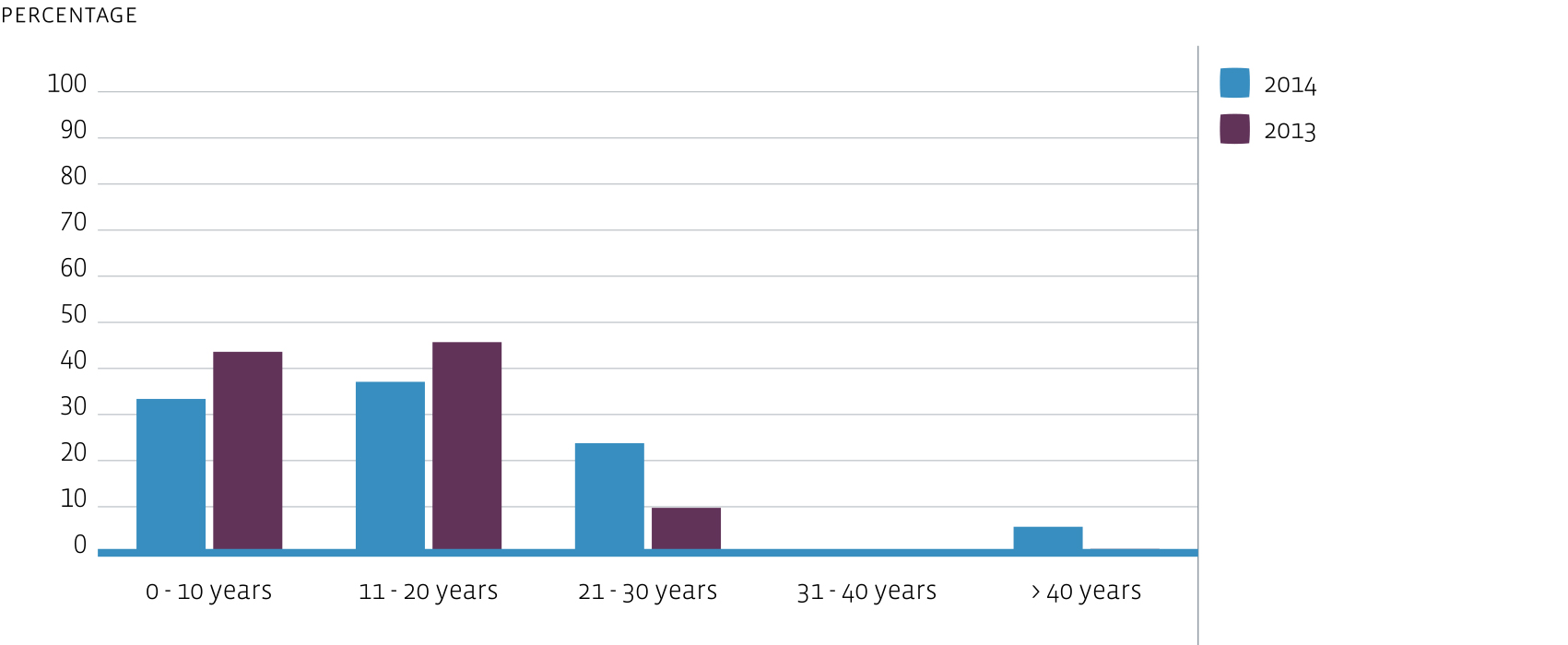

Asset optimisation

Although the buildings in the Fund’s portfolio are relatively young, a large part is now more than 10 years old. The lay-out of these buildings therefore generally needs to be updated and modernised to keep the building lettable in today’s market. The Fund has upgraded a number of empty spaces prior to closing new lease contacts. The renovation and letting of the Arthur van Schendelstraat office building in Utrecht is a perfect example of this approach.

Portfolio composition by age based on book value

More important than age is the asset's distinctive character, its location and return prognosis. As we acquired four existing buildings, two of which have a listed status, the average age of the portfolio has risen accordingly.

Investments in sustainability also increase the chances of new leases or lease extensions, as demand for sustainable offices is growing. These investments can also cut housing expenses, which gives office buildings a competitive edge in terms of pricing.

Area promotion

As part of our ongoing drive to forge sustainable partnerships with various stakeholders, Bouwinvest has always been involved in numerous area organisations, such as Utrecht-Rijnsweerd, the Olympic Stadium area in Amsterdam and the New Centre project in The Hague.

We frequently get involved at a very early stage, as we did in the formation of

Green Business Club Beatrixkwartier in The Hague, which was launched in 2014. Other initiatives included the promotion of the Hague as an attractive city by means of a book and a film and the promotion of The Hague as a business centre through

Locus. These and other initiatives give Bouwinvest the opportunity to improve and promote business districts to give them a truly sustainable future.