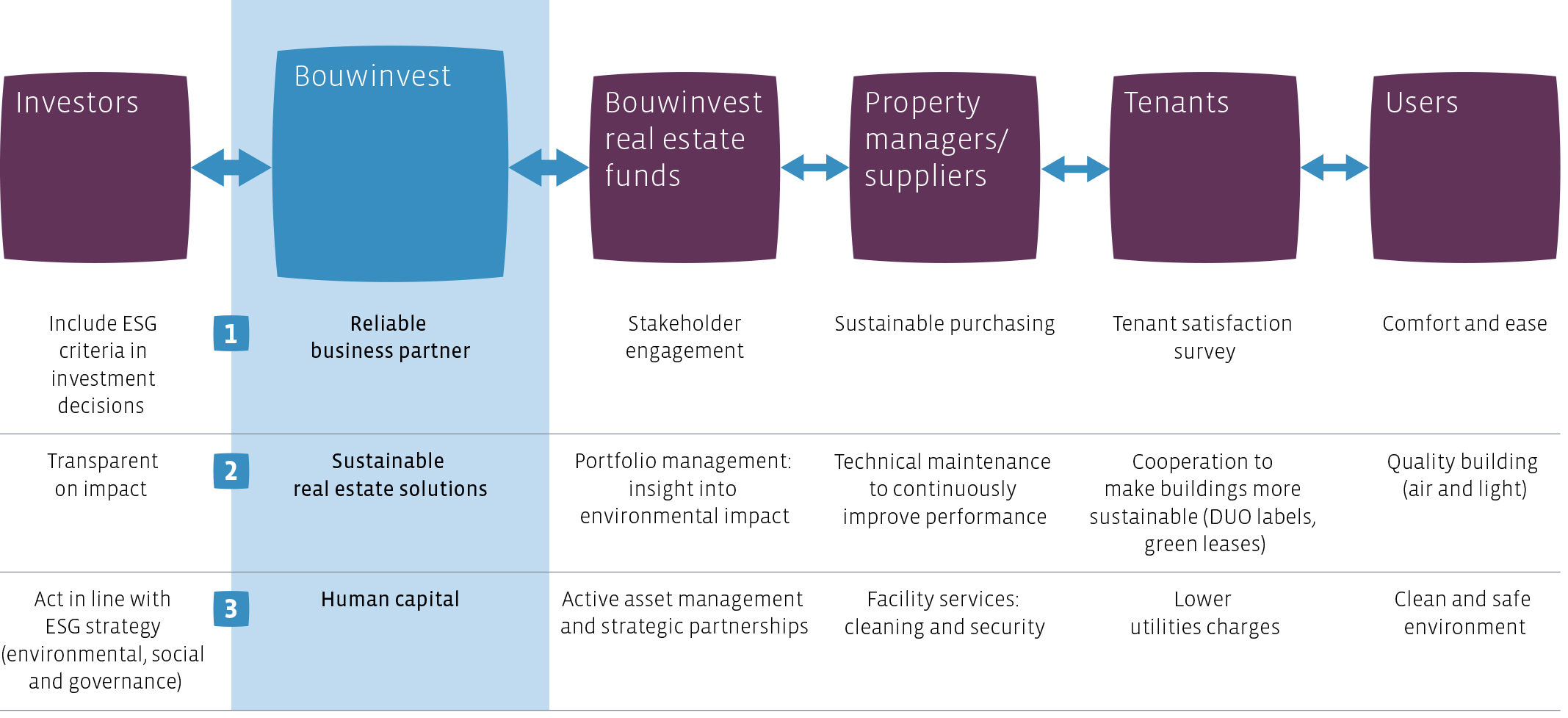

Our CSR pillars

Bouwinvest has divided its CSR mission and activities into three pillars:

- We aim to be a reliable business partner and meet the expectations of our investors through full transparency on our CSR track record and goals.

- We endeavour to continuously improve the sustainability of our investment portfolio in cooperation with all our stakeholders.

- Our goal is to be a flexible, ethical and fair employer to help our people to achieve Bouwinvest’s CSR ambitions.

Sustainability strategy and material issues

1. Sustainable and reliable business partner

Bouwinvest sees sustainability as an integral part of its business and we believe that transparency on where and how we impact society is a key element in improving our sustainability performance. This transparency gives us invaluable insight into the issues relevant to us and to our stakeholders, and enables us to define clear priorities and set concrete and measurable targets.

Value creation

In today’s challenging market, it is essential to be a reliable business partner both in economic terms and on the sustainability front. Of course investors are looking for added economic value, but now they also expect their partners to add social and environmental value. And they want complete transparency with regards to sustainability goals and performance and the related issues they find relevant.

See the Corporate governance section in this report for more details.

2. Sustainable real estate

Bouwinvest is constantly improving the transparency and sustainability performance of its three main sector funds, both at a bricks and mortar level and at fund level. We use globally accepted performance indicators (INREV, GRI) and sustainability labels (GRESB, BREEAM) to benchmark our performance and our progress. However, it is impossible to achieve real sustainability by yourself.

Joint effort

This is why one of Bouwinvest’s top priorities is to work with all its stakeholders to improve the sustainability its assets and its business as a whole. We work with our tenants, business partners and other stakeholders, such as local city councils, to create sustainable properties and local environments. Places where people will want to live, work or shop long into the future.

Dutch real estate funds win ‘Green Star’ status

Bouwinvest uses the Global Real Estate Sustainability Benchmark (GRESB) to measure and compare the sustainability performance of our three main Dutch sector funds. In 2014, Bouwinvest's three main Dutch sector funds once again actively participated in this initiative, which is aimed at boosting transparency and sustainability in the real estate sector. The result of the strategy and actions that Bouwinvest has taken to improve its environmental and social performance is that in 2014, well ahead of schedule, Bouwinvest's Residential, Office and Retail funds all moved up from ‘Green Talker’ to ‘Green Star’, the highest possible category in the GRESB rankings.

Benchmark international real estate investments

Last year, Bouwinvest also continued its active cooperation with other institutional investors aimed at increasing sustainability and transparency in the real estate sector. We extended our membership of GRESB and encouraged fund managers of our (international) indirect investments to participate in the GRESB benchmark.

The results of the GRESB benchmark were better in 2014 than in both 2013 and 2012. The response rate in the GRESB assessment in Bouwinvest’s international portfolio was also higher in 2014

Highlights GRESB and international portfolio:

- The number of participating investors in the GRESB benchmark increased again to 68% from 61% measured by NAV.

- The number of Green Stars increased to 15 from 11 for (unlisted investments) and doubled to 18 from 9 for listed investments. This means that the number of Green stars overall has more than doubled since benchmarking started.

- The international portfolio outperformed the benchmark with a average total score of 52 against 47 (global average), with a larger difference than in 2013.

- Throughout the portfolio the score showed a substantial increase. For the unlisted investments, 43% improved its score compared to last year (in 2013: 48%). For the listed investments the increase was even more impressive: 54%, following an increase of 31% in 2013.

Sustainability performance is now part of our key criteria in investment decisions and risk assessment, and we give a clear preference to investments with higher sustainability scores. The inclusion of the corruption index per country and the RobecoSAM country sustainability index in our internal Bouwinvest Global Market Monitor also enables us to assess and manage ESG risks even more effectively when selecting our international investments.

For more details, please see the CSR sections in our fund reports and the CSR performance indicators in this annual report.

3. A sustainable, ethical and fair employer

Bouwinvest sees its employees as its most important source of value creation. Our HR policy is aimed at providing the organisation with the knowledge, expertise and skills it needs and to develop the talents of our employees in a pleasant and stimulating working environment. The results of last years' employee engagement surveys show that this approach is working. For the past three years, Bouwinvest has booked a steady improvement in what we see as a one of the main spearheads of our HR policy. The most recent survey (2013) again showed an improvement of our employment engagement score, this time to 7.8, from 7.4 in 2011.

For more details, please see the HRM section in this report.